Say your business announces annual bonuses in December 2020 but pays them with the first payroll in January 2021. Since employees earned bonuses in 2020, you accrue a payroll expense for the bonus amount before the ball drops at midnight on Jan. 1. The journal entry for accrued interest expenses corresponds to the entry for accrued interest revenue. However, in this case, a payable and an expense are recorded instead of a receivable and revenue. Accrued payroll is the process in which the amount of money a business owes or is owed accumulates over time.

Generally, you accrue a salary expense in one period and pay for it in the next period. This means that you record the accrued salary expense in your books at the end of an accounting period. Hence, the accrued salaries journal entry would be a debit to the salaries expense account and a credit to the accrued salaries (or wages) account.

What is Accrued Wages?

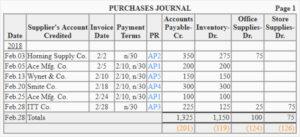

Every time you pay employees, you and your employee both owe Uncle Sam. Your business and its employees might also contribute to employee health and retirement plans. Accrued expenses include items such as interest expenses, salaries, tax expenses, rental expenses, or any other expenses incurred in one accounting period that will be paid in subsequent periods. Later, the $15,000 amount of salaries payable will be eliminated when the company pays its employees on January 03, 2020. For example, the company ABC Ltd. has the policy to pay current month salaries to its employees on the 3rd day of the next month period.

Let’s assume that a retailer’s hourly-paid employees are paid each Friday for the hours they worked during the previous week. The amount of the wages for the five days of December 27 through December 31 are calculated to be $5,000. In addition, the retailer incurred payroll taxes and fringe benefits amounting to $1,000.

Examples of Accrued Salaries in a sentence

This might be employee salaries, health care benefits, payroll taxes, or Social Security. To keep tabs on accrued payroll and gain insight into your business’s finances, keep in mind these sources of payroll accrual. When a payment is made to clear the dues for accrued salary expense, an entry must now be made to the Salaries Payable account and cash account. In this case, the business will again make two entries by debiting the Salaries payable account with the amount of the salaries paid and crediting the cash account with the same amount. In addition to improving budgeting and financial planning, payroll accrual can be used to reduce errors in payroll. In order to calculate accrued payroll, payroll expenses are determined in advance, which includes the calculation of salaries, wages, taxes and more.

EDITORIAL: The School District Mill Levy Override Decision, Part … – Pagosa Daily Post

EDITORIAL: The School District Mill Levy Override Decision, Part ….

Posted: Wed, 26 Jul 2023 11:10:37 GMT [source]

Accrued salaries refers to the amount of liability remaining at the end of a reporting period for salaries that have been earned by employees but not yet paid to them. This information is used to determine the residual compensation liability of a business as of a specific point in time. Payroll accrual is the total amount of salary, wages, and other compensation, like bonuses and paid time off, that employees have earned but haven’t been paid yet. For small businesses that use the accrual method for accounting, it’s important to record your expenses in the month they’re incurred, even if you pay for them later. Record employer-paid payroll taxes, such as the employer’s portion of FICA, FUTA, and SUTA. As I mentioned, I don’t owe FUTA and SUTA on Susie’s wages since I’m accruing payroll at the end of the year, after she’s earned more than $7,000 for the year.

Accounts Payable: Definition Recognition, and Measurement Recording Example

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. The interest is based on the previous outstanding principal balance of the note. After the trial balance had been drawn up, the December bill arrived, which was for $870.

To start, let’s look at what to include in your accrued payroll calculation. To calculate taxes and contributions, you can look at a similar payroll period or run the numbers through an online payroll calculator. The purpose of Adjusting Entries to accrue an expense is to recognize an expense as it occurs. The sum of all such adjustments for a period represent the total amount of expenses accrued by a company. Even though the December bill has not been recorded in the books, the fact is that the service has been received, and hence expenses incurred.

- The largest source of accrued payroll is likely to come from salary and wages payable to employees.

- For example, the company ABC Ltd. has the policy to pay current month salaries to its employees on the 3rd day of the next month period.

- Gross wages are an employee’s total compensation before payroll deductions, such as taxes and retirement contributions.

- Finally, the journal entry on 2 January 2020 reflects the second payment of principal and interest.

Thus, you pay less tax and increase your cash flow by pushing down income in years with the higher tax payment. Sometimes yes, accrued liabilities are current liabilities if the expense is due within a tax year. Accrued expenses tend to be incurred and paid in different accounting periods. While current liabilities tend to be settled within an accounting period. In this case, in the December 31 adjusting entry, the company ABC needs to make journal entry for accrued salaries to recognize the salary expense that has already occurred as below.

Accounting for Interest Payable: Definition, Journal Entries, Example, and More

Accrued salaries are an accounting concept that refers to the amount of salaries earned by employees for work performed during a specific accounting period but have not yet been paid by the company. Accrued salaries arise in businesses that follow the accrual basis of accounting, where expenses are recognized when they are incurred, not when the cash is paid. Therefore, an accrued salary account is important to ensure that the business’s financial records are correct in terms of accruals and in line with accounting principles. In this sense, payroll accrual describes your business’s payroll liabilities, i.e. how much you owe in payroll. No need to worry about tax until the entire commission check is settled. That amount is debited to the payroll expense account, increasing how much is owed.

The more precise accrual accounting method has you record transactions when you earn revenue and incur expenses, not necessarily when cash flows. Interest and salary expenses are accrued because the date that these items are paid does not necessarily correspond to the last day of the accounting period. For example, interest is often paid on a monthly or quarterly basis, while salaries are normally paid at regular intervals for work completed within the given period. The amount of liability that remains unpaid at the end of a financial year for the employees’ salaries is known as accrued salaries. It refers to any unpaid compensation at the end of the year that the business should record as an expense that has been incurred but has not been paid out yet to the employees.

Will be paid at a later date

In other words, it’s a way of representing an upcoming business expense. You may also hear it referred to as accrued payroll or salary accrual. At RL Good Candy, I’d accrue 10% of an employee’s wages for PTO (8 hours PTO earned / 80 hours worked in two weeks). For an employee paid $2,000 every two weeks, the PTO accrual is $200 ($2,000 bi-weekly paycheck ✕ 10%). Businesses that offer employees defined vacation and sick time need to track how much they’d walk away with if they left the company. With every payroll accrual, update how much your employee earned in vacation and sick time.

First on CNN: Biden administration launches new income-driven … – WKOW

First on CNN: Biden administration launches new income-driven ….

Posted: Sun, 30 Jul 2023 17:46:08 GMT [source]

QuickBooks Payroll makes managing payroll accounting easier for everyone from small business owners to larger-scale organizations. Sign up today to see how you can get started managing employee payroll for your enterprise with much more efficiency. Next, add the amount that you contribute to your employee’s health insurance premiums.

Include employer-paid payroll taxes and social security contributions

Let’s calculate accrued payroll using my fictitious candy factory, RL Good Candy, based in the District of Columbia. Employees contribute to health insurance and retirement by taking a pretax payroll deduction. Businesses often match employee 401(k) contributions or subsidize health insurance what is posting in accounting premiums. The timeline below shows the total amount of salaries expense for the week ended Friday, 4 January 2018. It also indicates how much expense should be allocated between the two years. This journal entry will recognize the liability of the business by recording outstanding salaries.

Simultaneously the amount is credited to your liability account, increasing how much is owed. Many accrued expenses will rest on the balance sheet for longer than a year. There is no special treatment in reversing it in the next year, since you are reporting the expense in the correct year. Accrued liabilities will affect your cash flow because it is a decrease to your profit.